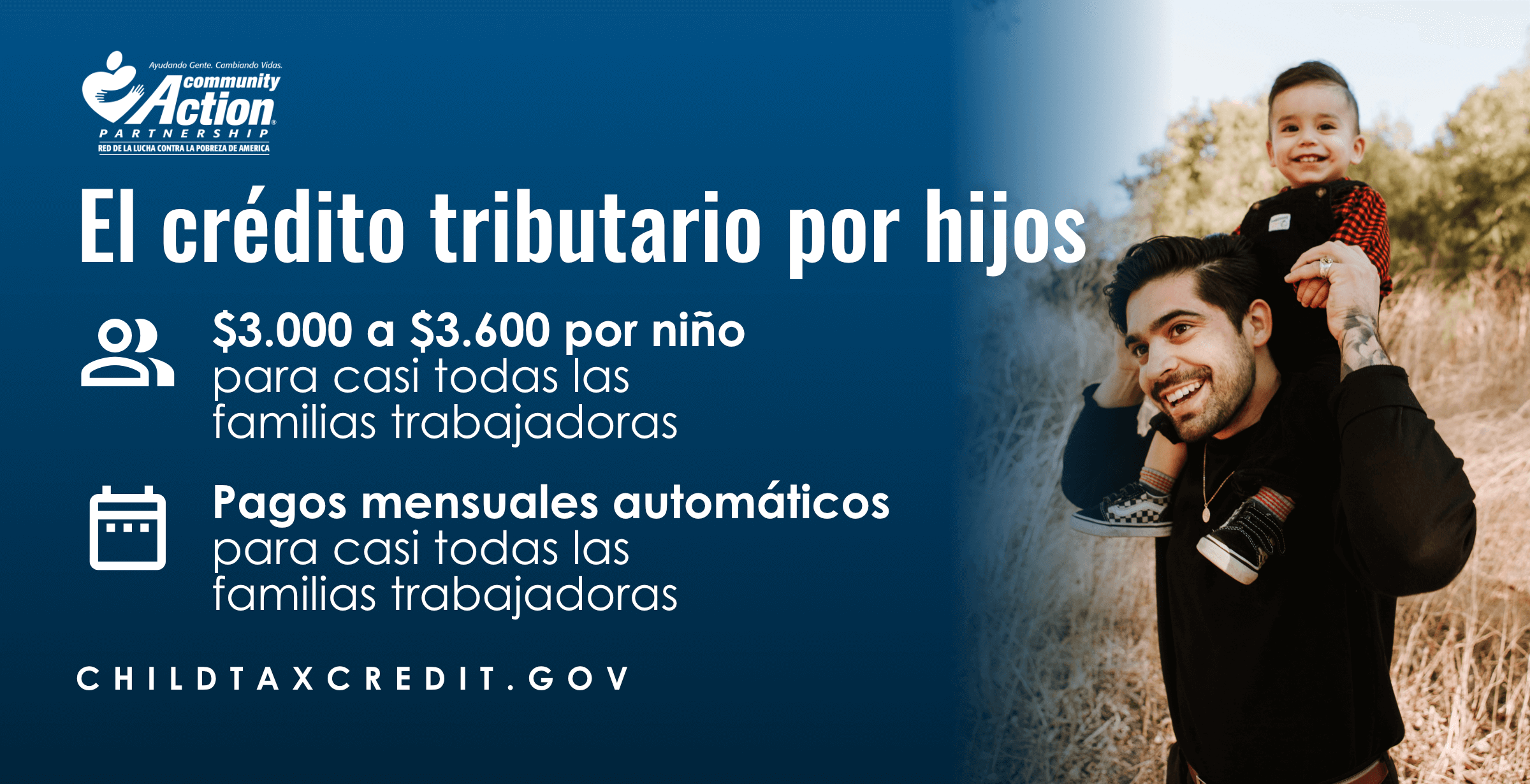

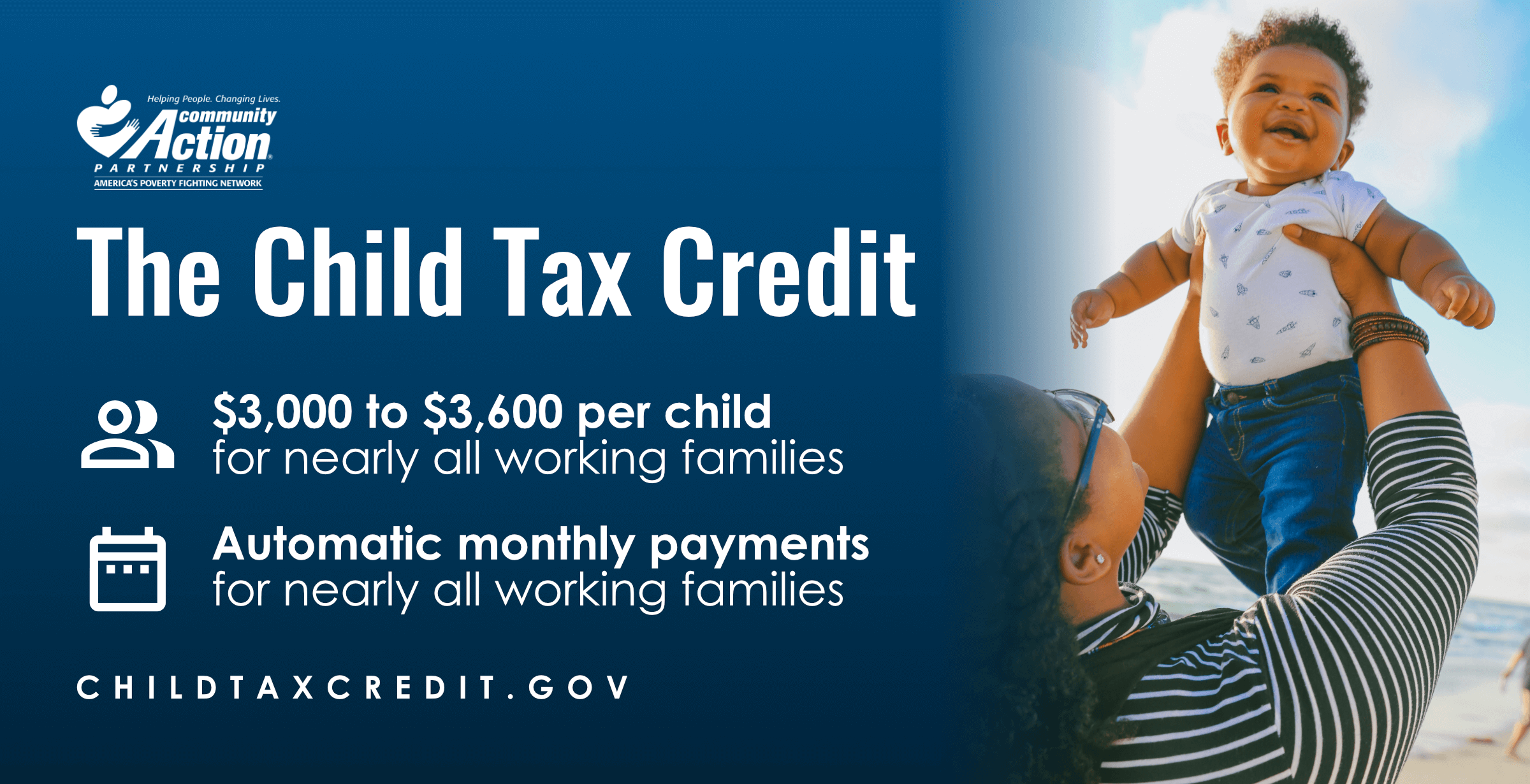

What is the Child Tax Credit

The Child Tax Credit program can reduce the Federal tax you owe by $1,000 for each qualifying child under the age of 17.

Important changes to the Child Tax Credit will help many families receive advance payments of the credit starting in summer 2021. The Internal Revenue Service (IRS) will pay half the total credit amount in advance monthly payments beginning July 15, 2021. You will claim the other half when you file your 2021 income tax return. These changes apply to tax year 2021 only.

Who Qualifies

To be eligible for this benefit program, the child you are claiming the credit for must be under the age of 17.

A qualifying child must be a son, daughter, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them (for example, your grandchild, niece, or nephew). An adopted child, lawfully placed with you for legal adoption, is always treated as your own child.

Visit IRS’s website to view unique eligibility criteria for Advanced Child Tax Credit Payments in 2021.

Additional Information

Please see Publication 972 for more information on the Child Tax Credit